iowa vehicle tax calculator

Page 5 of 9 3 Enter the sale date registration end date and annual registration fee for the vehicle. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Iowa local counties cities and special taxation districts.

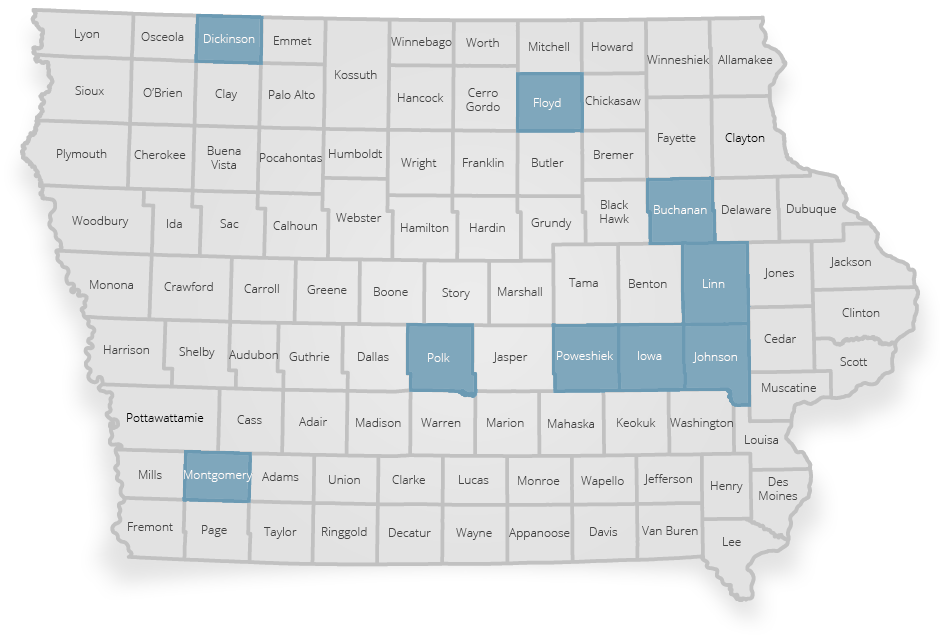

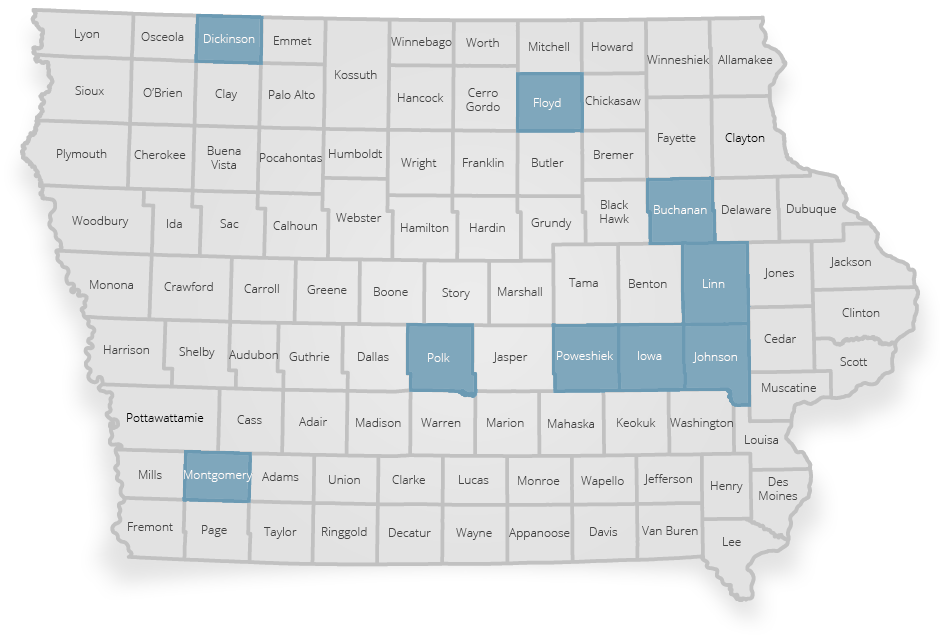

Select Your County Iowa Tax And Tags

Multiply the sales tax rate by your taxable purchase price.

. Collecting one-time new registration fee aka. Click Tools then Dealer Inquiry then Fee Estimator on the Iowa State Quote Tool to verify your registration cost and use the MVD Override to adjust the calculator. Grandfather Clause TitledRegistered prior to January 1 2009.

To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by 625 percent 00625. This deduction is for annual registration fees paid based on the value of qualifying automobiles and multipurpose vehicles. These fees are separate from.

Iowa has a 6 statewide sales tax rate but also has 832 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0988 on top of. For example if you purchased a car with a sales price of 16000 the tax on the vehicle is 16000 multiplied by 625 percent or 1000. Step 1- Know Specific Tax Laws In Arizona the sales tax for cars is 56 but some counties charge an additional 07.

Iowa Documentation Fees. The vehicle identification number VIN. Registration and document fees.

The state of Iowa requires you to pay taxes if you are a resident or nonresident who receives income from an Iowa source. For example if you purchased a car with a sales price of 16000 the tax on the vehicle is 16000 multiplied by 625 percent or 1000. It cannot exceed 400.

Standard MVD fees are about 412 on a 39750 vehicle and are calculated from a percentage of the vehicles value added to a weight fee. Model Year 1969 older -. This is equal to a percentage of Iowa taxes paid with rates ranging from 0 to 20.

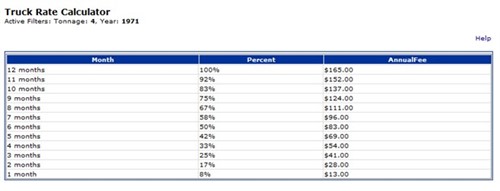

The number of credited months and the estimated credit appear under Results. Antique Vehicles - Motor vehicle 25 years old or older. Iowa Trust Savings Bank 2101 10th St Emmetsburg IA.

The County Treasurer is responsible for issuing vehicle titles registration renewals junking certificates personalized and other special emblem plates. The other taxes specific to Arizona are the Title tax of 4 the Plate Transfer tax of 12 and the Registration tax of between 8 and 120. Car Loan Calculator.

The date the vehicle entered or will enter the state you plan to register it in. You are able to use our Iowa State Tax Calculator to calculate your total tax costs in the tax year 202122. If you itemize deductions a portion of the automobile or multipurpose vehicle annual registration fee you paid in 2014 may be deducted as personal property tax on your Iowa Schedule A line 6 and federal Schedule A line 8.

Uh oh please fix a few things before moving on. The information you may need to enter into the tax and tag calculators may include. Oregon currently only collects tax on new vehicles.

Some cities can charge up to 25 on top of that. Standard minimum fee for the vehicle type applies. The tax is paid to the county recorder in the county where the real property is located.

Calculating a fee estimate You can calculate the estimated amount for all vehicle fees including the registration fee title fee plate fee use tax. To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by 625 percent 00625. A 5 sales tax is collected every time a vehicle is purchased in Iowa as a One Time Purchase Fee This fee is capped.

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. The make model and year of your vehicle. After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax.

UT 510 Manual pdf Vehicle Rental Sales Use and Automobile Rental Tax. The tax is imposed on the total amount paid for the property. Like many other states Iowa does collect a tax on car purchases.

How do I calculate taxes and fees on a used car. Model Year 1970-1983 - 23. A Brief Description of Motor Vehicle One-time Registration Fee.

And serving as an agent of. What is Transfer Tax. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

To view the Revenue Tax Calculator click here. If an allowable deduction was limited and added back for Iowa purposes in 2018 because of Iowas lower contribution limitation you may recalculate your Iowa contribution carryforward amount under IRC 170b1G for tax year 2019-2023 to include the amount of those contributions added back on your 2018 IA 1040 Schedule A. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Iowa requires both registration fees and title fees at the time that a vehicle is purchased within the state. Processing credits and refunds on vehicle registration fees. Notating and releasing security interests.

The date that you purchased or plan to purchase the vehicle. Our calculator has been specially developed in order to provide the users of the calculator with not only how. We cannot and do not guarantee their.

The calculation is based on 160 per thousand with the first 500 being exempt. For example if the total of state county and local taxes was 8 percent and the total taxable cost of your car was 18000 your sales tax would be 1440. PurchasedTransferred on or after January 1 2009.

Leased Vehicle Worksheet 35-050 Leased Vehicle Worksheet for Move-ins 35-051 Out-of-State Leased Vehicle Credit Worksheet 88-002 IA 843 Claim for Refund. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. The state income tax rates range from 0 to 853 and the sales.

So for example if your Iowa tax liability is 1000 and your school district surtax is 15 you would pay an additional 150. Average DMV fees in Iowa on a new-car purchase add up to 354 1 which includes the title registration and plate fees shown above. Please select a county to continue.

Iowa Sales Tax Guide And Calculator 2022 Taxjar

Calculate Your Transfer Fee Credit Iowa Tax And Tags

The Hourly Income You Need To Afford Rent Around The U S Being A Landlord Income New Things To Learn

Iowa Estate Tax Everything You Need To Know Smartasset

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Property Tax Pay Property Tax Scheduled Payments Reminder Email Important Dates Forms Faq Portfolio Service Portfolio Login Register To Pay Subsequent Tax Login To Pay Subsequent Tax Register And Bid For Tax Sales Fee Calculator Motor Vehicle

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Income Tax Calculator Smartasset

Sales Tax On Cars And Vehicles In Iowa

Iowa Vehicle Registration And Title Information Vincheck Info

Apply For An Online Car Loan Bike Loan And Scooter Loan Droom Credit Car Loans Car Loan Calculator Payday Loans

Registration Fees By Vehicle Type Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Accounting Worksheet Template Double Entry Bookkeeping Bookkeeping Templates Worksheet Template Spreadsheet Template

Small Business Income Statement Template Inspirational Monthly In E Statement Monthly Spreadsheet Profit And Loss Statement Statement Template Income Statement

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Department Of Motor Vehicles Ia Dmv Registration Renewal

Welcome To Bremer County Iowa Enjoy Online Payment Options For Your Convenience